Saleswhale Blog | 8 Min Read

“Ten million was wired to your account in Montenegro. I suppose you've given some thought to the notion that if you lose, our government will have directly financed terrorism.” — Vesper Lynd

Imagine this:

You are at a poker table with your friend.

Your friend is a strong poker player. You've seen him win at various state-side poker tournaments.

Due to a propensity for fast cars and partying, he's currently under-bankrolled. So, he asks you to stake him. Staking refers to the act of putting cash up on behalf of a poker player, and splitting the winnings.

Since you are putting up the capital, you decide to drive a tough bargain. You will make 80% of any profits, and the remaining 20% goes to him. If he loses, you will absorb 100% of the losses.

From an economic theory perspective, this sounds fantastic. Both sides are made better off because of the deal.

Your friend has the skills. You have the bankroll. Shifting the means of production to your friend makes sense. Failure to make the shift will be a manifestation of inefficient production.

However, things are not that straightforward in your drive for economic efficiency.

You have just created a situation of moral hazard for you and your friend.

Essentially, you are insuring your friend against losses. Now, he has no reason to avoid actions that may actually increase the probability of loss.

For example, engaging in risky plays, at a high-risk of ruin. Or optimizing for a huge pay-off. Or ignoring small, profitable wins because they don’t move the needle for him (he only gets to keep 20% of the profits).

This is the crux of moral hazard.

Due to information asymmetry (you can’t actually see the cards he is playing or understand his decision-making process), you may not know if your friend is acting in your best interest.

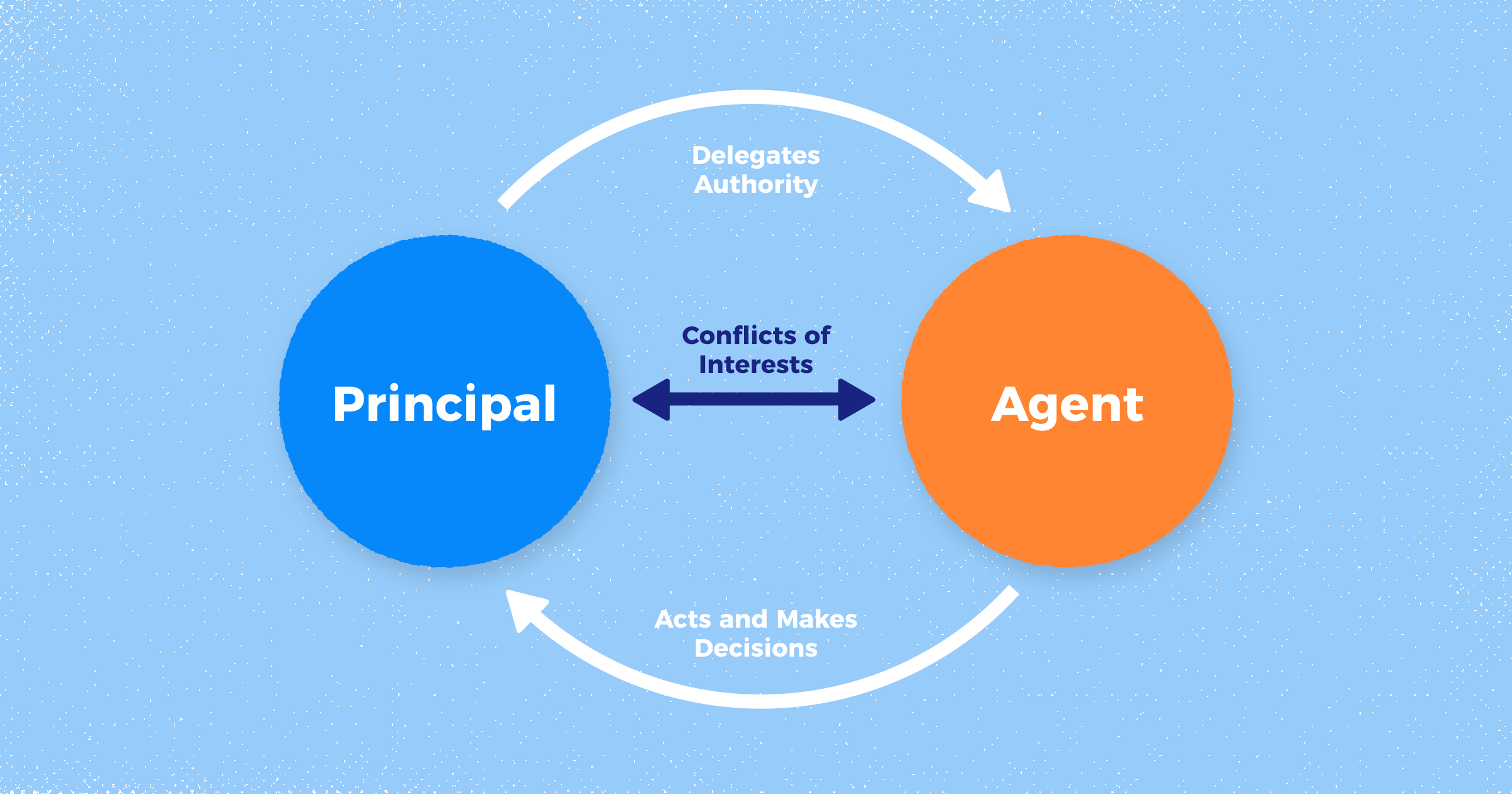

This in essence, is the principal-agent problem, and solving this problem is a field that’s intensely researched by economists.

There isn’t a one-size fit all solution to the above problem though. There are many different solutions. The solutions depend on the culture and relationship between principal and agent, and the solutions may actually change the culture.

It’s circular and recursive.

For example, how would the above situation change, if the friend was a childhood friend who is upright and whom you trusted a lot. As compared to an acquaintance with a reputation for angle shooting?

How would the dynamics change if you insisted on sitting behind him, and asked him to show you the hole cards before he played it? Or asked him to explain and justify each decision ex-ante? What if the casino forbids you to talk and communicate with your friend at the table?

Would you be as worried, if the table was full of soft players, ripe for the picking? As compared to a tough table, full of semi-professional poker players?

The set of logical solutions would differ from situation to situation.

Also, while there are multiple solutions, no one solution is perfect. Or, to put it another way, there are multiple solutions because no one solution is perfect.

Other than in perfect conditions, with zero-risk aversion and no information asymmetry, with each attempted solution, you incur “agency costs”. (Well-risk and information asymmetry is basically par for the course in poker and business.)

However, research has definitely shown that one type of solution can be systematically better than others in certain situations.

Hence, back to corporate land, one of the indications of good management is being cognizant of trade-offs between different “agency costs” associated with different situations and solutions.

As a marketer, you have undoubtedly come across a version of this problem when generating leads for your sales people.

You (the principal), hand over leads to a sales person (an agent) to follow up with the leads (take action on behalf of).

It’s efficient, because undoubtedly your sales people are more skilled at lead conversion and closing than you. Failure to do so, as mentioned above, is a manifestation of inefficient production.

However, there are two dimensions to the above.

Consider this, say you hand over 200 leads to your sales team. You find out that only 30 were followed up with, and 170 were not followed up with.

You may ask your sales team, “why didn’t you follow up with the leads?”

Some of them would say, “Oh, we did follow up with the 170 leads but we couldn’t get in touch with them.”

Others would say, “Oh the 170 leads are junk, they are not worth our time.”

What is the ground-truth?

How do you know who is telling the truth?

If you assume that your sales people are telling the truth, should you adapt your your marketing campaign and channels to bring in “better leads”?

Making decisions on false or misleading data can be severely detrimental.

But wait, there’s a third, and hidden dimension to the above too.

As marketers, you serve as a principal for your sales team. But as employees, you yourselves are an agent for another set of principals!

As the saying goes, "Great fleas have little fleas upon their backs to bite 'em, and little fleas have lesser fleas, and so ad infinitum. And the great fleas themselves, in turn, have greater fleas to go on, while these again have greater still."

You are agents of your management team, who have appointed you to generate leads and pipeline.

This means that, depending on incentives (contract design), this may also induce high moral hazard in you and your behavior.

Consider this, your company quotas and compensates you on MQLs. The previous marketing team got fired because they failed to hit MQL targets. You are under a lot of pressure to generate aggressive month on month growth in MQLs. Will you care about the quality of the MQLs? Will you care if the sales people are having trouble closing these MQLs? Probably not.

Here's a common scenario among misaligned sales and marketing teams during management meetings:

Head of Sales: “The leads are shit.”

Head of Marketing: “The leads are great. Your reps are lazy.”

Who should the management believe?

Without the proper ground-truth data, it's back to the information asymmetry problem between principals (management) and agents (marketing & sales leadership). It’s tricky to keep sales and marketing aligned.

Using a principal-agent problem approach, we can try to deconstruct the issues above:

One way to mitigate the principal-agent problem between you and your friend in the poker analogy above, is to make your friend bear some of the risk of his own money too.

As management:

More and more companies are moving away from measuring marketers on just raw leads, or even MQLs generated.

At Saleswhale, we call these > 2.0 marketing-mature companies:

As marketers:

You should definitely enforce lead routing, recycling and reallocation (the 3 Rs).

“Take away/reassign any leads that aren’t followed up with quickly. Maybe within 24 hours. Or even faster. Route leads that aren’t rapidly followed up with to a rep with time to talk to them. You gotta do this. Leads not only go stale — which is important — but when a rep doesn’t follow up almost instantly, that’s in general a clear sign she just isn’t excited about the lead. Send it instead to someone that is.”

Jason Lemkin, SaaStr

As sales people:

You should understand the incentive structure of your marketing team. Voice out to your VP Sales/management team if you feel that your incentives are mis-aligned.

As Upton Sinclair put it, “It is difficult to get a man to understand something when his salary depends upon his not understanding it.”

To get better, high-intent, sales-ready leads, it's a good idea to solve upstream and help your company fix incentive design before anything else.

Also, come up with a service-level agreement (SLA) to govern all of the above, with clear triggers on next steps if the SLA is breached.

e.g. “Leads should be first-touch followed up within 24 hours, and with X touches within 72 hours. This is our contract between sales and marketing. If you don’t do this, this is what will happen to the leads…”

One way to mitigate the information asymmetry problem in the above poker analogy is to see all the hole cards your friend is playing. This helps you understand if he's taking unnecessary risks. The second-order effect of him knowing you are observing will also influence his behavior.

How this translates to a sales-marketing context:

Make sure that you set up your Salesforce CRM or system of record correctly.

As a marketer, build reports around "Last Activity At", and "Tasks" to gain better visibility into lead handling.

If possible, connect your sales reps' calendar events and emails to your CRM to automate the data collection, and reduce administrative burden on your sales team.

The idea is to make sure you have unified and accurate ground-truth data to make informed decisions on. This beats "he said, she said" any day.

Use this data to drive alignment and accountability around lead follow up. Also, use it to attribute sales efforts and opportunities to the originating marketing campaigns.

"Marketers are constantly debating with Sales about attribution and sourcing. They need to look for something that offers full visibility into which campaigns are driving opportunities and which opportunities are driving the success of campaigns." -- Terry Flaherty, Senior Research Director, Demand Marketing at SiriusDecisions

The impetus to reduce information asymmetry and make data-informed decisions, is responsible for the rise of Sales/Marketing Ops and Revenue Ops in modern companies.

An upstream thinking or meta way to get rid of the principal-agent problem, is to avoid getting into it in the first place, without sacrificing production efficiency. If you were to improve your poker skills, and upgrade your own capabilities, could you become less reliant on staking other players?

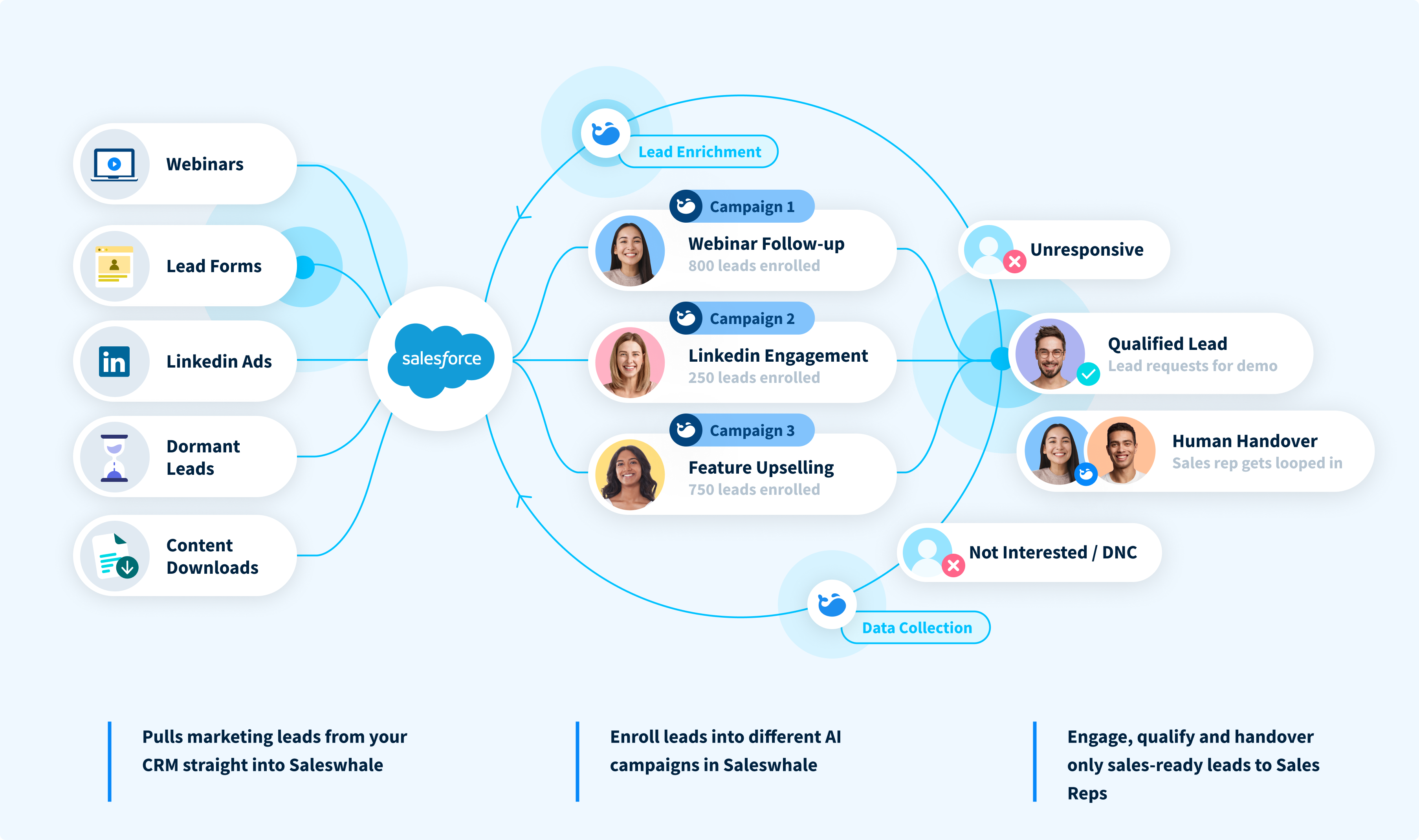

As a marketer, you could reduce the dependency on sales follow ups by:

Through automation, the agency problem becomes less of an issue, as you are now less reliant on human foibles and misaligned incentives.

Much depends on the culture and incentive design of your company.

Be careful not to implement solutions, especially draconian and heavy-handed ones, blindly.

Solving this problem is not easy. But, it's worth trying.

For sales and marketing teams, having a well-designed system that minimizes the principal-agent problem could mean the difference between success and failure for sales and marketing alignment.

Catherine Farley is the Director of Marketing at Saleswhale. She has 10+ years experience designing unimaginable marketing campaigns and storytelling. Catherine is the proud owner of two Great Pyrenees and due to their shedding is rarely seen wearing black.

Sign up for cutting edge ideas on conversational marketing, AI assistants and martech.

Saleswhale for Salesforce allows you to build powerful automated lead conversion workflows. This allows you to re-engage with your neglected marketing leads at...

19 APR 2021

Demand generation and marketing teams generate more leads at the top of the funnel than ever in this new digital-first world. Saleswhale helps ensure those...

1 MAR 2021

Marketers that focus on MQLs end up doing the wrong things in order to achieve the metrics. So I changed it.

16 JUN 2020

Conversica isn't the only player out there. Learn how Saleswhale and Exceed.ai compare and make an informed decision.

15 APR 2021

By providing your email you consent to allow Saleswhale to store and process the personal information submitted above to provide you the content requested.

You can unsubscribe at any time by clicking the link in the footer of our emails. For information about our privacy practices, please visit our privacy page.